The Big Five ESG Frameworks: A Strategic Roadmap for Executive Value Creation

Introduction

The business world is experiencing a fundamental change in how organizations are evaluated and valued: ESG factors are now critical to long-term success. Investors, once solely focused on financial metrics, now recognize that issues like climate change and corporate governance significantly impact performance and value creation. This awareness has triggered an unprecedented demand for reliable, decision-useful ESG data, forcing executives and Chief Sustainability Officers (CSOs) to transparently communicate their efforts and performance. The complex web of global reporting standards is not a regulatory burden, but a strategic opportunity to articulate value, manage risk, and secure a competitive advantage.

Convergence Landscape

The challenge for executive teams operating globally, has been navigating a fragmented reporting environment. While governments worldwide are introducing new regulations, the core industry movement is one of convergence, driven by the push for standardized, comparable, and consistent information. This profound transformation is merging financial and non-financial reporting, with the ultimate goal of providing stakeholders with integrated and decision-useful information.

The 'Big Five,' the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-Related Financial Disclosures (TCFD), the International Integrated Reporting Council (IR Framework), and the new International Sustainability Standards Board (ISSB) form the basis of this global shift. They represent the essential toolbox for any organization seeking to align its corporate strategy with its sustainability goals.

Deep Dive on the Big Five ESG Reporting Frameworks

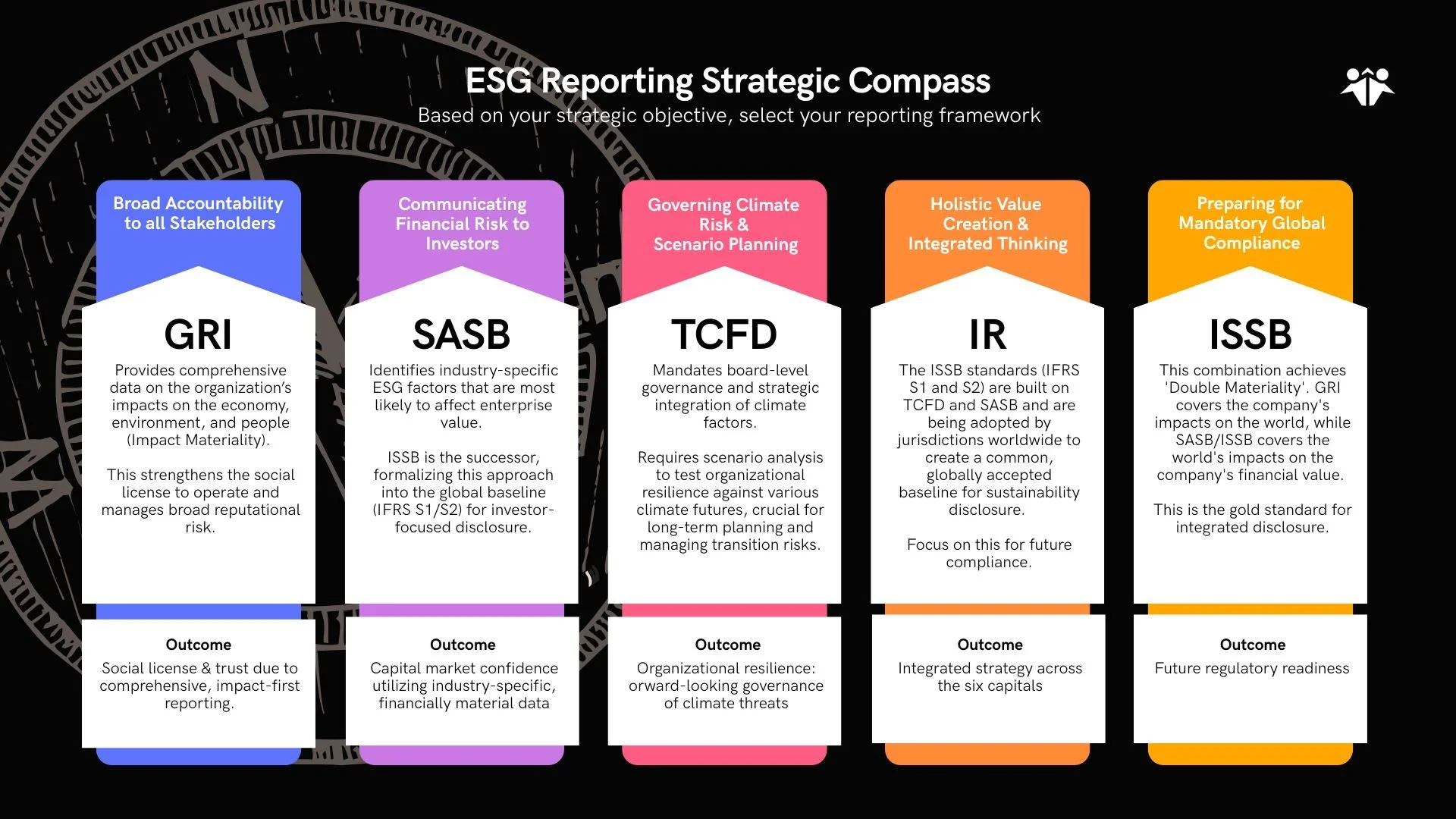

Below is an outline that helps you navigate selection of your ESG Reporting Framework:

ESG Reporting Compass

1. Global Reporting Initiative (GRI): The Standard for Comprehensive Impact

Purpose and Focus: The GRI is the world’s most widely used set of standards for sustainability reporting. Its core philosophy is to enable an organization to report its impacts on the economy, environment, and people. It operates on the principle of impact materiality, meaning it requires disclosure on issues where the organization’s activities have significant impacts, regardless of whether those impacts affect the company’s bottom line today.

Strategic Value for Executives: For executives, GRI provides the framework for achieving comprehensive transparency and maintaining the social license to operate. A GRI report is the definitive tool for communicating with a broad range of stakeholders—including customers, employees, civil society organizations, and local communities—who are keenly interested in how the company manages its environmental and social responsibilities. Adopting GRI demonstrates universal accountability, strengthens stakeholder trust, and effectively manages reputational risk across the entire value chain.

2. Sustainability Accounting Standards Board (SASB): The Standard for Financial Materiality

Purpose and Focus: Now governed by the IFRS Foundation, SASB’s mission is to help businesses identify, manage, and report on financially material sustainability information. Unlike the GRI’s impact focus, SASB operates on financial materiality, focusing on sustainability topics that are likely to affect the enterprise value, or the assets and liabilities, of the company. Crucially, its standards are industry-specific, covering 77 different sectors, ensuring that disclosures are relevant and comparable within competitive peer sets.

Strategic Value for Executives: SASB is the essential framework for investor relations and capital allocation. By adopting SASB, executives are communicating directly to financial markets and institutional investors, providing them with the ESG data they need to inform investment and voting decisions. Implementing SASB allows CSOs to strategically pinpoint and report on the specific ESG risks and opportunities that truly impact long-term financial performance, thereby translating sustainability performance into the language of the market.

3. Task Force on Climate-Related Financial Disclosures (TCFD): The Standard for Climate Risk Governance

Purpose and Focus: Established by the Financial Stability Board, the TCFD created a universal framework for disclosing climate-related financial risks and opportunities. Its recommendations are structured around four core pillars: Governance, Strategy, Risk Management, and Metrics & Targets. The TCFD is unique in demanding disclosures that are forward-looking and based on scenario analysis, forcing organizations to test their resilience against various climate futures.

Strategic Value for Executives: TCFD is fundamentally a risk management and governance tool. It requires executives to embed climate considerations, including physical risks (e.g., extreme weather) and transition risks (e.g., policy changes), into the highest levels of corporate decision-making.

For a CSO, TCFD is the roadmap for future-proofing the business, demonstrating to shareholders and regulators alike that the organization has robust controls and a clear strategy to navigate the impending climate transition. It is rapidly becoming a mandatory requirement across major global economies.

4. The IR Framework (International Integrated Reporting Council): The Standard for Integrated Thinking

Purpose and Focus: The IR Framework (now part of the Value Reporting Foundation, which merged into the ISSB) promotes a shift from siloed reporting to 'integrated reporting.' It challenges organizations to look beyond the financial statements and connect the dots between strategy, governance, performance, and prospects.

The framework is built on the concept of the Six Capitals (Financial, Manufactured, Intellectual, Human, Social & Relationship, and Natural), showing how an organization uses and impacts all resources to create value over time.

Strategic Value for Executives: The IR Framework elevates reporting from a compliance exercise to an internal strategic process that drives integrated thinking throughout the organization. By requiring leaders to articulate the links between material ESG issues and the business model, the framework helps executives communicate a concise, holistic narrative that demonstrates sustainable value creation to both investors and internal stakeholders. It is about understanding and reporting the full spectrum of an organization's resource dependencies and impacts.

5. International Sustainability Standards Board (ISSB): The Future of Global Disclosure

Purpose and Focus: Established by the IFRS Foundation, the ISSB is the new, consolidated standard-setter tasked with delivering a global baseline for investor-focused sustainability reporting. Its first two standards, IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures), are built directly from the architecture of TCFD and SASB, formalizing their principles into a globally accepted, assured set of standards.

Strategic Value for Executives: The ISSB represents the convergence standard and the future of mandatory disclosure. For executives operating globally, compliance with IFRS S1 and S2 will soon be non-negotiable. Its value lies in providing the long-sought stability and comparability in reporting, allowing organizations to streamline their disclosures while meeting the rigorous demands of institutional investors. Adopting the ISSB framework now is the most effective way to prepare for forthcoming global regulatory shifts and to position the company as a credible and transparent global player.

Conclusion

The convergence of global ESG frameworks marks the end of optional, fragmented sustainability reporting. Executives and CSOs must now proactively adapt to this change, viewing the 'Big Five' not as separate compliance burdens, but as interconnected strategic tools. By embracing these frameworks, organizations can enhance the quality and consistency of their disclosures, secure competitive advantage, and ensure they are best positioned to thrive in an increasingly sustainability-focused business environment. Success now depends on integrated thinking and strategic disclosure.